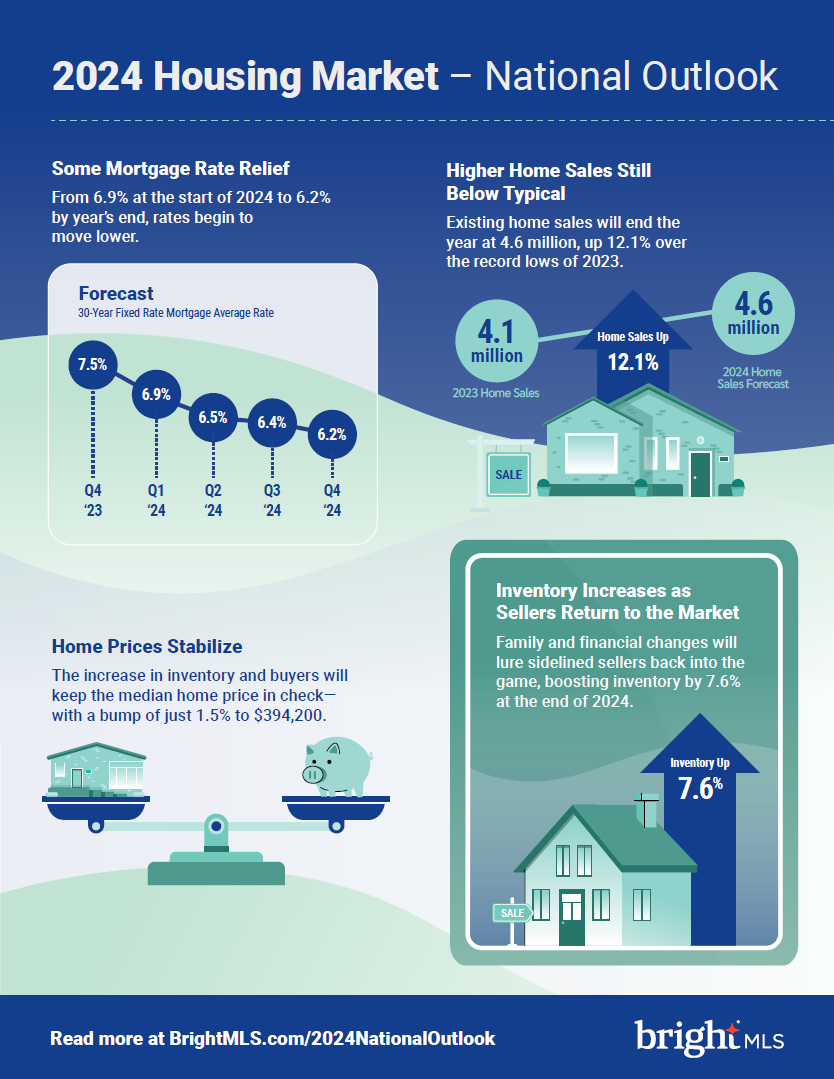

Our nationwide overview of next year’s housing market forecasts stable prices, lower mortgage rates, and more homes to choose from as sellers leave the sidelines.

Mortgage rates will come down in 2024.

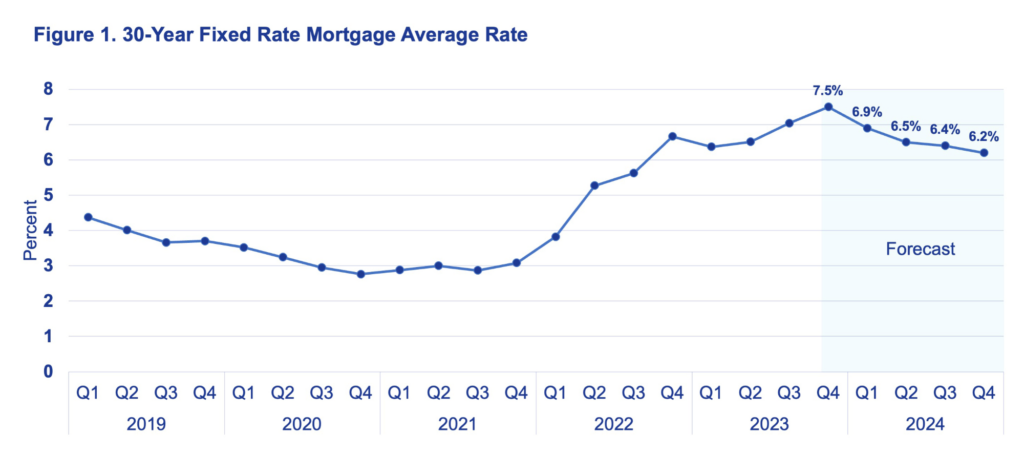

Mortgage rates, which reached a more than two-decade high in the fourth quarter of 2023, will begin to come down in 2024. However, buyers and sellers waiting for rates to return to pandemic levels will be disappointed.

We are in a new era for mortgage rates, in which prospective homebuyers should expect rates to settle at between 6% and 6.5% next year. A year and a half of interest rate hikes led to rapidly escalating mortgage rates, and the Federal Reserve has indicated that they are committed to keeping interest rates higher for longer. But there are other factors that will keep mortgage rates elevated for the foreseeable future, including persistently high bond yields, which keep mortgage rates elevated.

The average rate on a 30-year fixed rate mortgage is forecasted to fall below 7% in the first quarter of 2024. Rates will continue to fall throughout the year, reaching 6.2% by the end of 2024.

There will be more home sales next year.

In a typical year, there are about 5.2 million sales of existing homes. But it has been a long time since we’ve had a “typical” housing market. The number of home sales in 2023 is projected to be at its lowest level since 2008, as low inventory, elevated mortgage rates, and high home prices have cooled demand, particularly in the second half of the year.

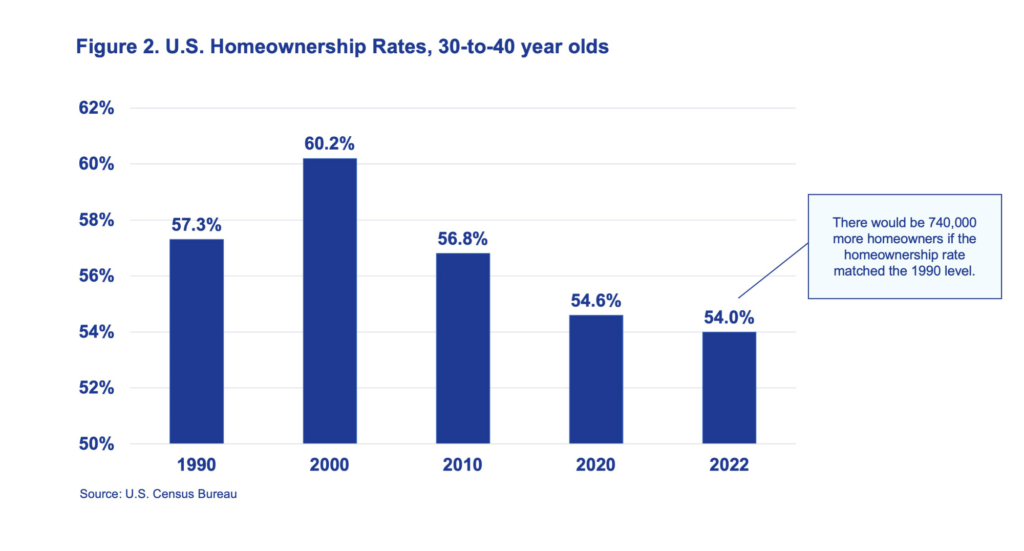

There is still significant pent-up demand for homeownership, as the homeownership rate for younger households is still much lower than it was for previous generations. Lower rates and more inventory will bring more buyers into the market in 2024. Affordability will still be a challenge, however, which will keep some prospective buyers out of the market altogether in 2024.

The forecast is for there to be 4.6 million sales of existing homes nationwide in 2024, about 500,000 more sales than in 2023, a 12.1% gain. Looking ahead, sales will likely return to levels around 5 to 5.2 million over the next two or three years.

More people will list their homes for sale in 2024.

Inventory hit historic lows during the pandemic and a lack of supply has been a major constraint on the housing market. Inventory began to rise in many markets in 2023, primarily because of a slowdown in new contracts, as opposed to an increase in new listings. It is expected that overall active listings at the end of 2023 will be up by 23.6% compared to the trough of 2022.

Supply has remained low in part because some homeowners who might have listed their home are staying put because they have a very low mortgage rate. Nationally, more than 60% of homeowners with a mortgage have an interest rate below 4%. With rates near 8% at the end of 2023, few homeowners are enticed to trade out that low rate.

Supply will loosen up in 2024. Even homeowners who have been characterized as being “locked in” to low rates will increasingly find that changing family and financial circumstances will lead to more moves and more new listings over the course of the year, particularly as rates move closer to 6.5%.

More new listings will add to inventory, though overall supply will remain low. There will remain a structural deficit in available supply, even as inventory is projected to be more than 90,000 additional listings on the market at the end of 2024 compared to the end of 2023, a 7.6% gain. Nationwide, active listings will still be below 2019 levels, though the gap will have narrowed so that year-end 2024 inventory will be at 92% of the year-end 2019 level.

Home prices will be relatively stable in 2024.

Between 2019 and 2022, the median home price nationally rose by more than 40%, or by about 13.7% annually, a much faster past of price appreciation than during a typical market. Strong demand during the pandemic, fueled by historically low mortgage rates and increased savings, drove up home prices. Price growth has moderated in 2023, and the forecast is for the 2023 median price to be up by just 1.1% compared to 2022.

Looking ahead, several factors will push and pull at home prices. More inventory will be generally offset by more buyers in the market. As a result, it is expected that, overall, the median home price in the U.S. will grow modestly, rising to $394,200 for 2024, a 1.5% increase over 2023.

Affordability will be a bigger factor in the market.

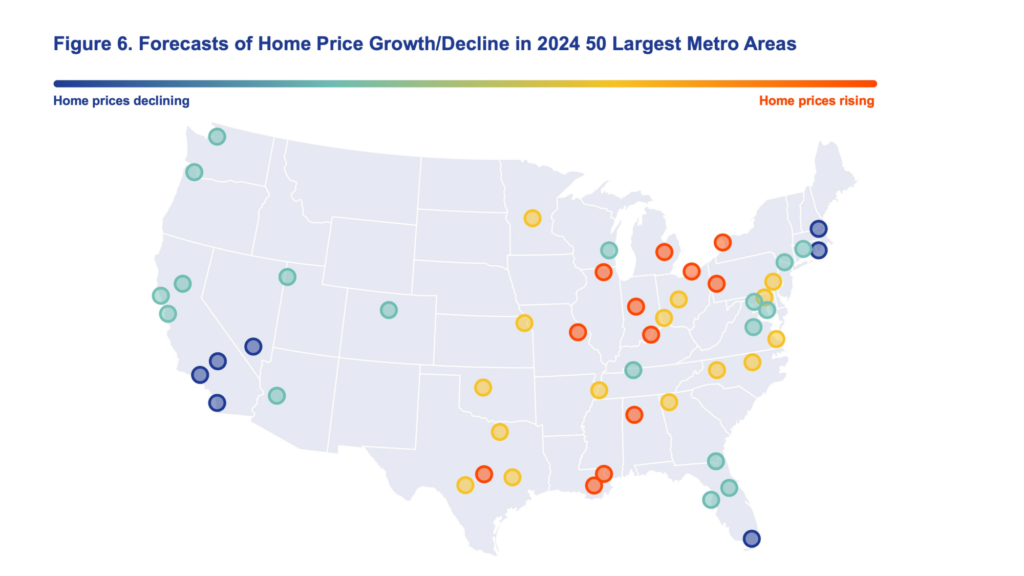

While there is no evidence to suggest major, widespread home price corrections in the U.S. in 2024, there are some local markets where home prices have risen much more quickly and where affordability is a major obstacle for prospective buyers. Over the past year, new construction activity has also accelerated in some metros. As unaffordability takes the edge off demand and more new single-family homes add to supply, there is the potential for downward pressure on prices in some markets across the country.

Based on an analysis of home price growth, affordability, and new single-family construction trends, there are 10 metro areas (out of the 50 largest metro areas) where the median price in 2024 is forecasted to be lower than the median price in 2023. Markets in California and Florida dominate the list of places where home prices are forecasted to decline in 2024, though in no market is the forecast for a double-digit price drop next year.

Metros with 2023–2024 Price Declines

Miami, FL

San Diego, CA

Las Vegas, NV

Riverside, CA

Los Angeles, CA

Boston, MA

Tampa, GL

Nashville, TN

Austin, TX

Orlando, FL

Conversely, there are many regions, particularly metro areas in the Midwest, where home prices have been rising more in line with incomes and where inventory still remains low.

Metros with Prices up 5% or more in 2024

Indianapolis, IN

Buffalo, NY

New Orleans, LA

Chicago, IL

St. Louis, MO

Birminham, AL

Cleveland, OH

Louisville, KY

Pittsburgh,PA

Detroit, MI

Lisa Sturtevant, PhD