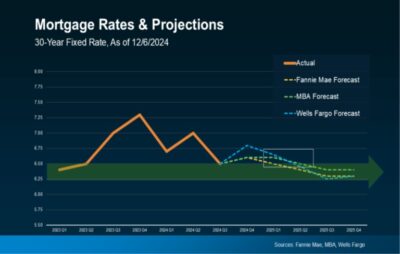

The 30-yr fixed mortgage rate is now expected to stay elevated between 6% and 6.5% for the next two years.

The forecast is far from guaranteed. In January 2023, some analysts thought that rates would be around 4.5% by the end of 2024, which obviously didn’t come to pass.

Federal Reserve Chair Jerome Powell says it best; “Forecasts are highly uncertain. Forecasting is very difficult. Forecasters are a humble lot with much to be humble about.”

Rates will stay relatively high as long as the economy keeps outpacing expectations – and either way, economists don’t anticipate a dip into the 3% or 4% range in the foreseeable future.

The November Housing forecast from Fannie Mae puts the average 30-year fixed rate at 6.5% in the beginning of 2025, declining to 6.1% in the second quarter of 2026.

The MBA predicts in its November Mortgage Finance Forecast that mortgage rates will gradually slide from 6.6% at the beginning of 2025 to 6.3% throughout 2026.

Near shocking numbers (68.6%) of US homeowners have paid off their mortgage or have at least 50% of equity in their home.

Many homeowners are sitting on a mountain of equity thanks to double-digit home price appreciation since 2020. Successful sellers can tap into that equity to put toward their next home purchase.

Michelle Davis, SVP, Sr Divisional Sales Leader, Prosperity Home Mortgage